An Evolving Property Landscape

The number of new apartments hitting the market has already peaked and is likely to fall year-on-year, making it even harder for first-home buyers looking for somewhere to live.

A new report from Charter Keck Cramer shows that new apartment completions in Sydney peaked at 30,000 in 2018 and has been declining ever since, with a small blip this year. [1]

Brendan Woolley, Charter Keck Cramer’s director of research, says NSW is falling well behind the target set under the federal government’s $350 million National Housing Accord.

“These targets are not realistic,” he told ALAND executives and staff at a special briefing in Strathfield.

Under the housing accord, the NSW government has pledged to build 375,000 new dwellings between 2024 and 2019, or 75,000 new dwellings a year; the majority of these (52,000) are earmarked for sites across Greater Sydney.

“Since Covid-19 onwards we have not even hit the 10-year average for building completions – we need between 22,000 and 25,000 new apartments each year, but we are not getting anywhere near this target,” he said.

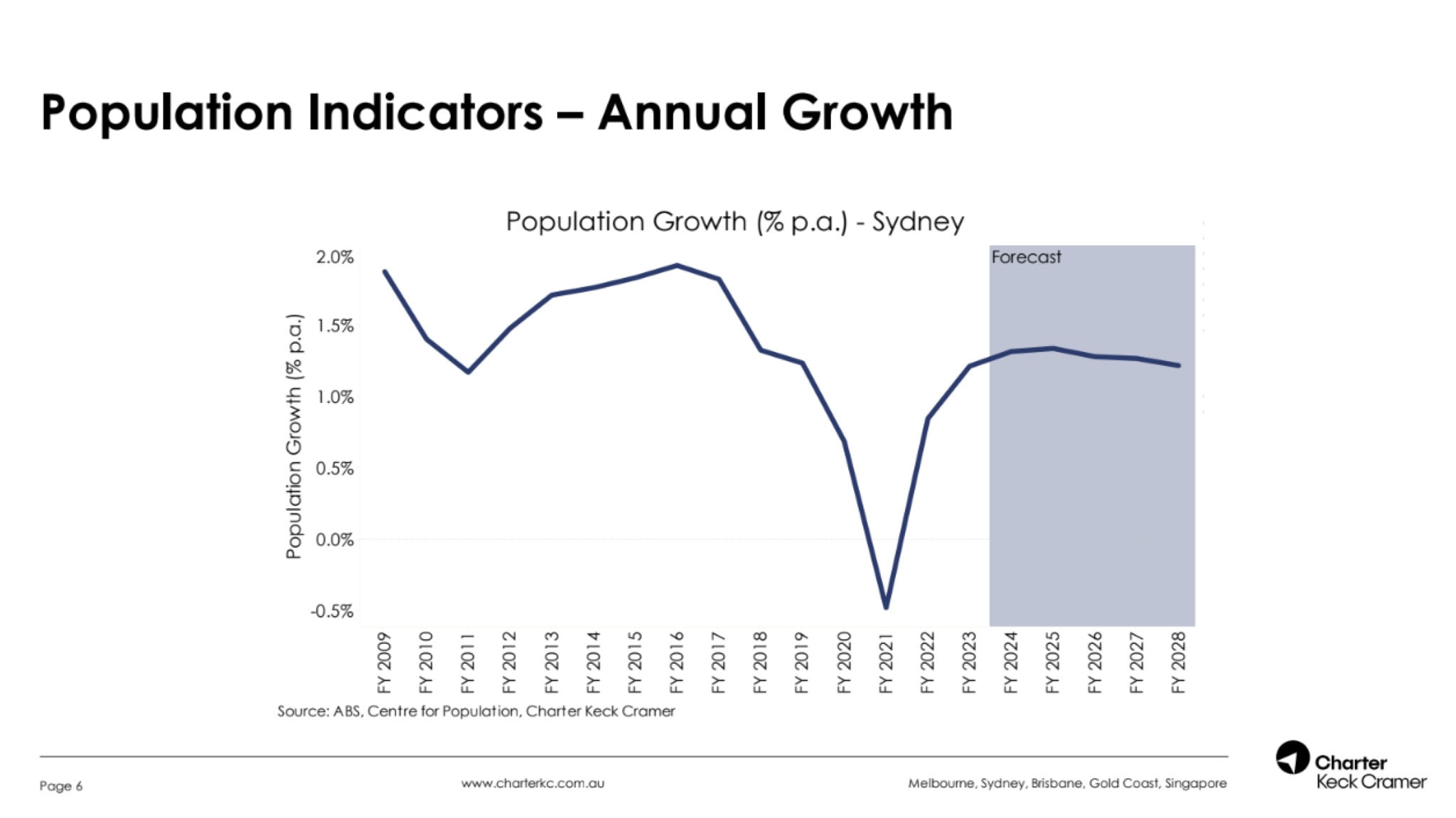

Immigration Numbers Surging

Mr Woolley says this construction data needs to be set against a backdrop of high immigration, most of which was targeted at Australia’s two largest cities, Sydney and Melbourne.

“In 2023 the number of people coming to NSW peaked at 174,000 compared to 75,000 in the pre-Covid years,” he said.

“This is a significant catch-up after the border closures were cancelled [during the pandemic]. That 174,000 figure represents around 34% of all people coming into Australia.

New arrivals are also cited in a new report by Oxford Economics as contributing to Australia’s ongoing housing crisis.

Report author Timothy Herbert says that while new housing construction is tipped to reach record levels by the end of the decade, it will not be enough to meet the surge in demand.

“While industry capacity is showing signs of improvement in [some] areas, labour shortages remain that will place a speed limit on the early to mid-stage of the recovery,” he said. [2]

Oxford Economics predicts that Australia will build just 960,000 new homes between now and 2029, well below the 1.2 million target set out in the National Housing Accord.

Rise of Masterplanned Developments

As Australia’s residential housing landscape continues to evolve Charter Keck Cramer detects a shift towards design-led apartment developments rather than stand-alone projects.

Brendan Woolley believes that today’s owner-occupiers, including a growing cohort of downsizers, are now looking for stylish design, communal amenities and sustainable features.

“Design-led, masterplanned projects are finding a lot of success in the market – with multi-stage projects outperforming standalone projects,” he said.

Mr Woolley cited the example of Schofield Gardens, ALAND’s multi-stage development in Schofields, which has attracted both owner-occupiers and investors since it launched in 2019.

Downsizers are having a major influence on the residential housing sector – often selling freestanding houses to buy more affordable and lower-maintenance townhouses or units.

“That [movement] trickles down and affects both the purchase and rental markets,” he said.

“After 13 cash rate rises many people are having to rethink their household budgets – which is why design-led projects are coming to the fore.”

What the future holds

While Mr Woolley is encouraged by initiatives unveiled by the NSW government, especially its commitment to fast-track so-called infill development sites around train and bus stations, it remains cautious about the future.

“There’s still a lot of pent-up demand in the market, plus a significant under-supply issue,” he said. “The gap between supply and demand has never been wider.”

Charter Keck Cramer warns that unless things change significantly over the next couple of years, renters in Sydney will come under growing pressure to find affordable property.

“Rents will continue to go up,” said Mr Woolley

At a time of surging overseas migration into NSW, the number of new apartments being built in Sydney is actually stagnating, with smaller numbers (less than 5,000) coming online in 2027.

The National Housing Accord officially began in July 2024, but few observers believe that any of its targets, however worthy, will actually change anything, at least in the short-term.

The Housing Industry Association predicts a housing shortfall of 180,000 new homes over the next five years and is calling for tax relief, planning reforms and incentives to attract more workers to the industry. It is a plea that is going unheard.

Sources: